Commercial Work Trucks For Sale in Saline, MI

Power Up Your Business

Looking to equip your fleet with reliable, hard-working trucks for sale in Saline, MI? Look no further than Genthe Chrysler Dodge Jeep Ram! We offer a vast selection of new and used Chrysler, Dodge, Jeep, and Ram work trucks specifically designed to handle even the toughest of jobs.

A Fleet of Advantages

Interested in shopping our work trucks for sale in Saline, MI? They come with plenty of pros, including:

Increased Efficiency: Our work trucks offer excellent fuel economy and impressive towing capacities, allowing you to tackle more tasks in less time.

Reduced Operating Costs: Durable construction and long-lasting performance minimize maintenance needs and repairs.

Top Models on the Market: A unified fleet with the power of Chrysler, Dodge, Jeep, or Ram work trucks for sale from Saline, MI, projects a strong, capable image for your business. We suggest taking a look at the Ram Heavy Duty pickup trucks which include the Ram 2500, the Ram 3500, and the Ram 4500. We also carry the Ram ProMaster van series to browse.

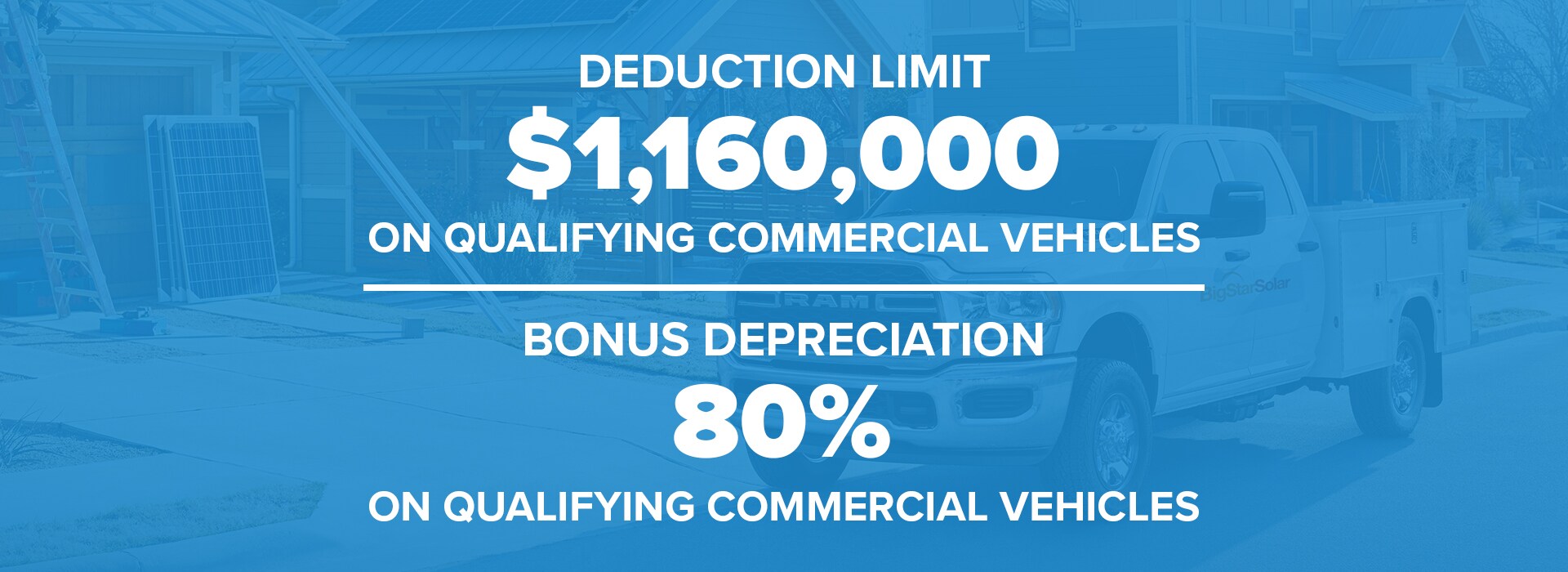

Commercial Sized Savings: Did you know the IRS allows businesses to deduct a significant portion of the cost of qualifying work vehicles under Section 179? This can be a major financial advantage for your company. Let's delve deeper into the details below!

What is Section 179?

Section 179 is an IRS act that lets businesses deduct the full price of qualifying equipment (vehicles in this case) in the year they are purchased or financed. It's essentially a government incentive to get businesses to invest in themselves by lowering their tax burden when they buy necessary tools. This means you can significantly reduce your taxable income simply by acquiring qualifying work trucks for sale from Saline, MI. It's a win-win for businesses and the economy, as it encourages growth and innovation.

Who Qualifies for Section 179?

The good news is that most businesses can benefit from Section 179 in 2024! However, there's a spending limit in 2024. The maximum deduction you can take is $1,220,000, and this amount starts to decrease once your total spending on qualified equipment reaches $3,050,000. Here's a quick rundown of the vehicles available for full tax deduction:

- Large Passenger Vans

Vans designed to carry a large number of passengers, typically with seating for more than nine behind the driver, qualify. Think shuttles or airport transportation vehicles. - Dedicated Cargo Vans

Classic cargo vans with a completely separate cargo area from the driver's cabin usually qualify. These are ideal for deliveries or hauling equipment. Take a look at the Ram ProMaster van collection! - Heavy-Duty Trucks

Big rigs and tractor-trailers used for commercial purposes can be fully deducted under Section 179. Shop from our Ram pickup trucks! - Specialized Business Vehicles

Vehicles designed for a single business purpose, like ambulances or hearses, often qualify for the full deduction.

You might still qualify for a partial tax deduction under Section 179. Here's the breakdown:

- If your truck or SUV weighs more than 6,000 lbs. Gross Vehicle Weight Rating (GVWR), you can claim a partial deduction as long as you use it for business more than half the time.

- For pickups exceeding 6,000 lbs. GVWR and with a full-size 8-foot bed used for business over 50 percent of the time, you can generally claim a partial deduction. Our Ram work trucks for sale in Saline, MI, such as the Ram 1500 are perfect for this partial deduction.

- For heavier SUVs (still over 6,000 lbs. GVWR), there's a maximum deduction limit of $30,500 for vehicles placed in service in 2024, as long as business use exceeds 50 percent.

In short, Section 179 offers a significant tax advantage to businesses that invest in new equipment in 2024. Check the spending limits and qualifying property details to see if your purchases qualify and which work trucks for sale in Saline, MI, are eligible!

Shop Commercial Work Trucks for Sale in Saline, MI

There are plenty of work trucks for sale in Saline, MI, that qualify for the Section 179 tax credit. And they are all waiting to be discovered by you on our lot at Genthe CDJR. Visit our dealership to take a closer look in person or browse online to find your perfect fleet!

* The advertised price does not include sales tax, vehicle registration fees, other fees required by law, finance charges and any documentation charges. A negotiable administration fee, up to $115, may be added to the price of the vehicle.

* Images, prices, and options shown, including vehicle color, trim, options, pricing and other specifications are subject to availability, incentive offerings, current pricing and credit worthiness.